Working with a large UK e-commerce company, the Head of Marketing has a rough rule of thumb for splitting revenue when budgeting. They apportion it as:

Working with a large UK e-commerce company, the Head of Marketing has a rough rule of thumb for splitting revenue when budgeting. They apportion it as:

- 1/3 on product development and sales support

- 1/3 on marketing

- 1/3 contribution towards costs and overheads & profit

The company’s profit is about 10% of revenue. The Head of Marketing had received varying claims from solution providers estimating return on investment of up to 30-40% for a given channel. In looking to support their campaigns and evaluation, we got challenged on why we were only proposing an ROI figure of 5%.

Rationalisation to tackle saturation

A marketing budget is made up of lots of components – such as channels, creative, messaging. In some cases, we have seen as many as 500k listed activities in a plan. Typically, though these can be rolled up and rationalised.

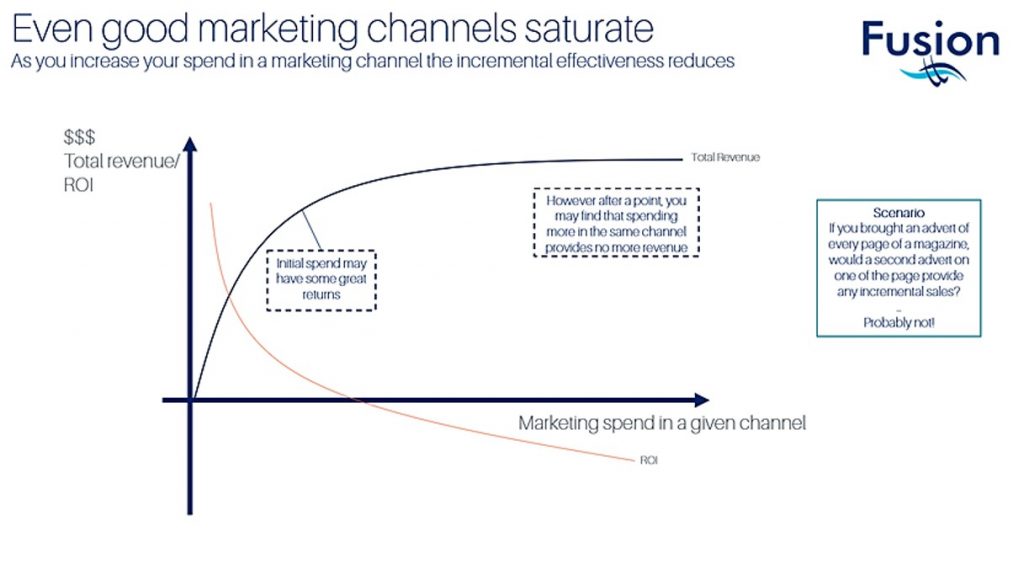

Let’s say you have 500 rows of activities in your marketing plan. Each channel typically has what is called a saturation point. This is when you cannot get more return for any marketing spend. For example, if you advertised in every page in a newspaper, you probably wouldn’t see an uplift for a second advert on the same page. The message has already got through to the audience.

To get an uplift in overall revenue, you need to both reduce or cut spend (in lower performing channels), and increase spend in better performing channels – which are not yet saturated.

It’s not however a case of just removing 5% of spend in one channel and adding it to another. Instead it is better to spread it across several. This can mean reviewing and addressing around 30-40% of the current marketing budget’s activities to achieve an overall budget uplift of 5%.

Is the juice worth the squeeze?

30-40% is quite a proportion of the budget and planned activities, but in the case of our client the approach made serious commercial sense and here is why.

30-40% is quite a proportion of the budget and planned activities, but in the case of our client the approach made serious commercial sense and here is why.

Firstly this approach did not impact the overall marketing costs, nor the overheads of the business. So out of that 5% the Head of Marketing got to retain 2/3 of the revenue, or 3.3%.

When the overall company’s 10% profit margin increased to 13.3%, that optimisation essentially improved profitability by 33%!

So whilst changing 30-40% of the budget may only result in 5% increase in revenue. That 5% increase of revenue with the same cost base can increase profitability by 30-40% – something certainly not to be sniffed at!

What’s the catch?

Of course to achieve that improvement, you need to be prepared to make some big changes. Suppliers offering smaller cost-savings of 1-2% may seem pointless, but the accumulative impact that can have to the overall bottom line can be impressive.

So, with the constant pressure to demonstrate marketing’s effectiveness and articulate its value to a business, it is worth periodically looking out for saturation points. Reviewing your current channels, rationalising and reapportioning budget away from static to more effective performers can bring serious commercial gains.