Each company is structured differently, but generally several departments will have a say in the overall forecasting of the business.

As Finance teams control the budget, this can often mean that they have “final” say on the plan but usually not involved at the detailed level of each function.

So how do they know they are considering all angles?

Different departments have different considerations:

- Product or buying teams often think of the product life cycle, and look to balance the right levels of stock against potential sales.

- Marketing will be looking at the channels which can generate sales, enquiries or traffic.

- You may have a sales team or a CX/CRO team that look at how to convert that traffic to sales.

Finance need to take these inputs and balance the overall business performance with the aims of the business.

The business might want to be a low-cost, high return or spend more to achieve a higher EBITDA.

There are other factors Finance have to consider too. There may be certain ways to represent marketing investment to help increase the value of a company; like adding good will or brand value on the balance sheet (which means brand spend rather than cheaper direct channel spend). Or you may have limited access to funds, that you have to balance against growth.

Whatever your situation, there usually is a point where Finance have to pick through a range of plans and try to tie them together.

Planning factors are not totally independent between each team

Often the planning process can get drawn out, we had one instance where a large international brand tool over six months to plan; and therefore had teams dedicated to constantly planning

In this instance, the product teams could predict the growth patterns of each product, whilst account teams could forecast the predicted account sales (accounts would be stores that bought their products).

The reason it took so long was each team that has produced a plan has used a set of assumptions. Some of these assumptions are unknown or not considered by other teams, whilst others do overlap.

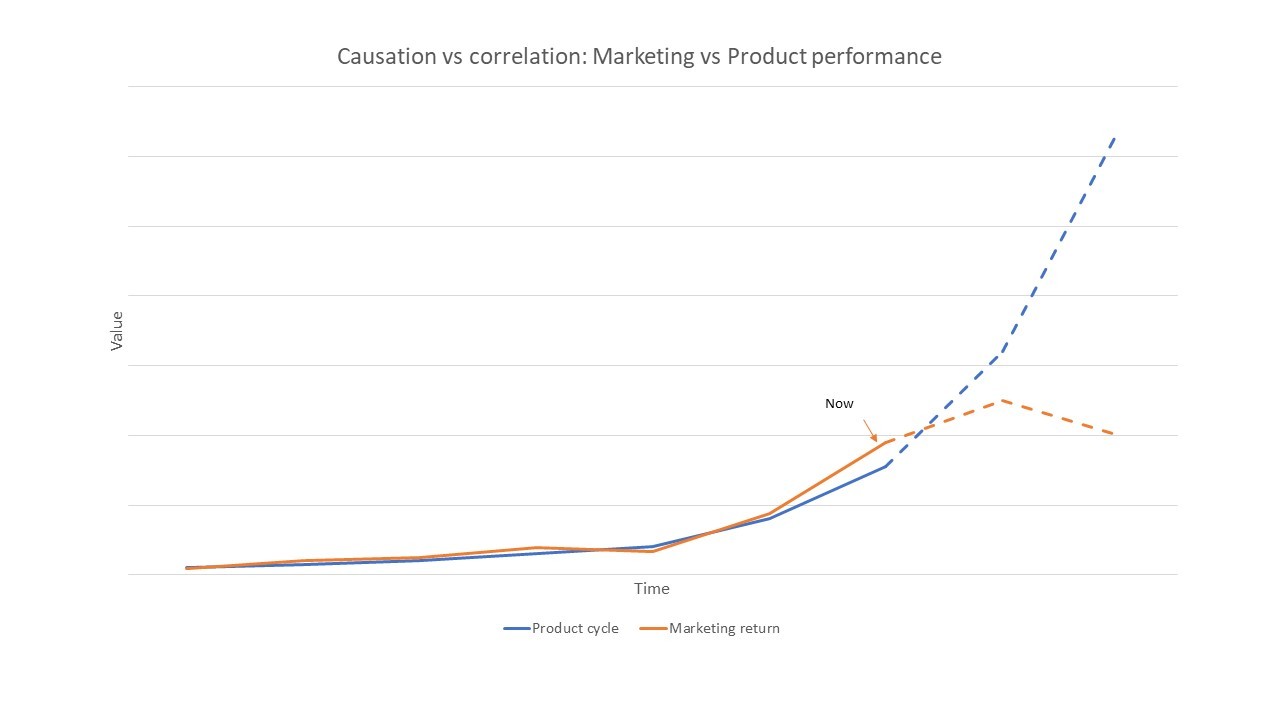

The chart below shows a hypothetical example of this. If up to this point (now on the chart) market conditions were stable or good, a product was launched, with Marketing support, both would correlate with each other.

However, say then that market conditions worsen, or if the target audience has peaked, the product team may not account for that. Similarly, Marketing may not fully comprehend the success of a product.

On the other hand, Marketing would often look at a mix of products; and perhaps have accounted for the general trend; that some products are rising whilst others are falling.

When Finance get their plans from various teams it can be tricky for them to decipher. Have both the teams account for market factors; how do these interplay?

This scenario can happen in every type of business. Other examples could include:

- eCommerce companies; Different customer groups may have a 20-50% higher LTV, therefore it can sometimes make sense to recruit the right customer at a loss (or lower profit) for long term growth.

However, product teams are often charged with an ROI off each product; making them target less valuable, less loyal but higher initial value customers.

- Insurance companies, often will use marketing to generate leads, whilst sales focus on conversion. Product teams then have to price within the market; which then makes it hard to decipher what is driving conversion; price or experience.

Not all plans can scale

To overcome the challenges of long planning cycles, some CFO’s may have set a clear strategy and hand over point. Insurance is a great example of this with Marketing predicting enquiries and Ops/Product teams estimating conversion.

The trouble that you have is that say Finance work close with ops to optimise price, they then may need to then provide Marketing with a different target.

How can Finance help other teams (like Marketing) plan?

It is important for Finance to help manage this process and articulate exactly what they expect of each team.

Our top three tips are:

- Have a clear objective

When going into any period, you are likely to have an idea of what a plan will show. i.e. if the market is bad, you are likely to also have a bad time.

Ultimately forecasts and plans are based on the judgement of the individual presenting them. Rather than an open question such as “what will our sales be next year?” a more targeted question like “what will it take to grow 10% next year?”

This can often lead to a more precise outcome.

2. Share some initial metrics

For a recent client, they had an overall target growth plan; which meant they had to achieve a certain level of Ebitda.

Typically, this will be calculated/estimated by a mix of how many new customers they recruit, of what type (i.e. if they have different LTVs) and their spend estimates over the next three years vs. cost.

Some initial high-level assumptions about that calculation will enable other teams to get nearer to it; requiring less iteration.

For example, knowing what the Ebitda calculation is, Marketing can consider whether then need to invest heavily in brand to achieve profitability, or whether they manage costs will that produce a smaller but more profitable business.

3. Help the teams align their plans

Each team will have their own thoughts on growth and why their way is right.

Independent pieces of insight often fail to be adopted when they do not tie together different teams approaches or terminology.

In an ideal world to overcome this you would produce a central view or model on how the business works; giving clear direction as to who is responsible for each assumption. However, this can take time to achieve.

Another route to take a step forward in this direction is to create a set of agreed principles and KPI’s between departments. Some examples of this would be; creating customer segmentations, or defining more custom KPIs.

Uncertain times often mean more planning & more waste

In uncertain economic times, the need for Finance teams to have their fingers on the pulse of the business will only increase.

If you are worried about the future and foresee the needs to adapt and change, it is important that you take these initial steps as soon as possible, to reduce the overhead of each planning iteration.