Around 80% of our work is actually delivered through partners, limiting the brands we can openly talk about. If you want to understand more about our digital analytics, database development, or analytics capabilities; or if you want to understand more about what we can do in B2B, retail, eCommerce, travel, & FS please get in touch.

Supporting a start up travel company with their customer acquisition

Our client would help transport sports equipment like; golf clubs, bikes and skis, from peoples home to their hotel.

To buy use their services consumers would need to know where & when they were going, and not to have booked. This meant there was often a delay in their purchase cycle; making most digital reporting systems break!

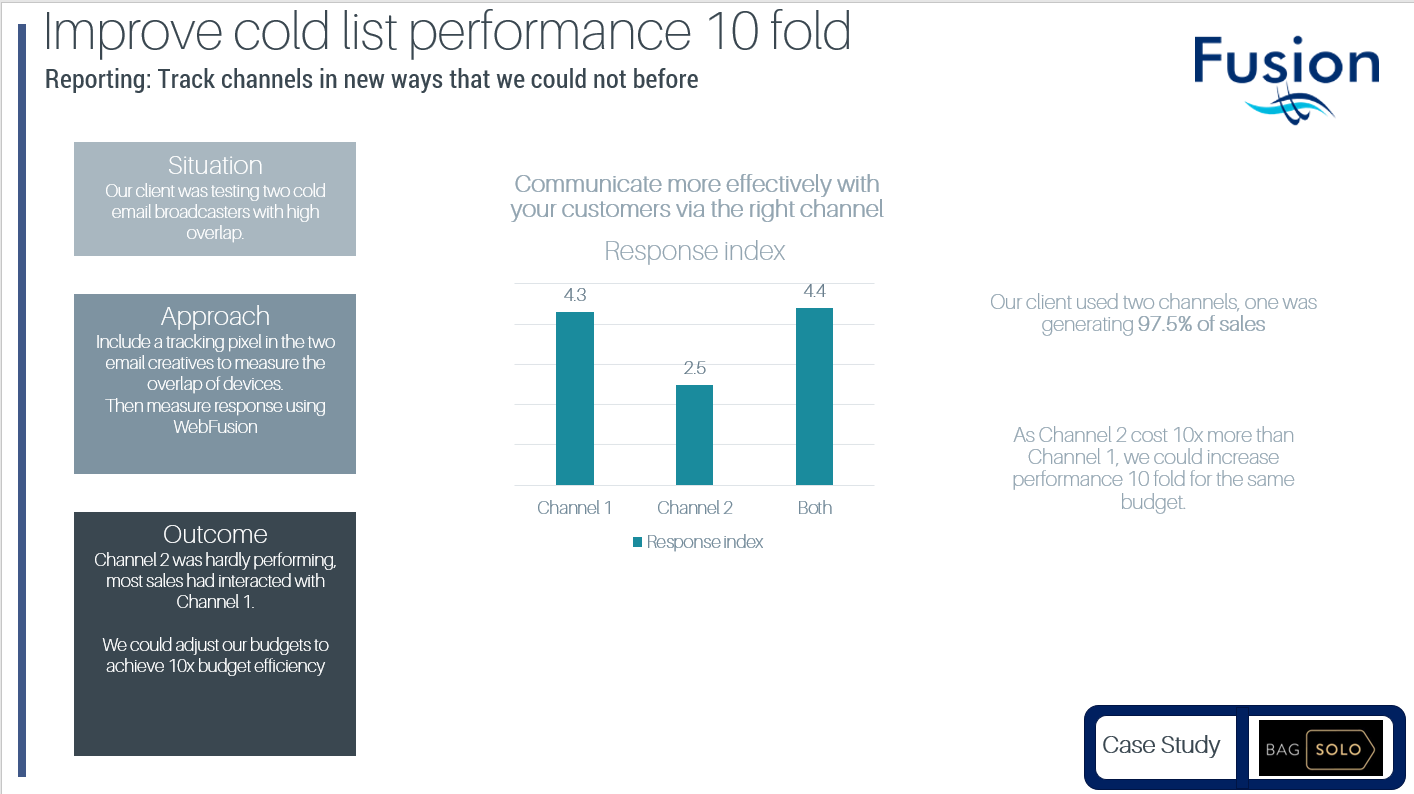

WebFusion helped track the customer journey from partner companies like golf clubs, or publishers; and then link that to the customers that bought both online & offline.

We ran a range of projects, to help identify which marketing channels were actually working, and which ones had higher levels of cross over with existing channels.

Supporting Beetle Juice cocktail bars manage their customer communications better

Beetle Juice provide mobile cocktail bars to festivals & events, private functions, as well as supporting B2B customers activate their brands.

In total they had a fleet of 15+ mobile bars, some owner managed and other franchised out. However responsibility for booking events was held with the head office. This meant that in total there could be over 1000 events per year to arrange.

WebFusion could capture and integrate the incoming prospect data, and import it into their CRM & mailing systems. This ensured that people could be injected straight into marketing channels and no prospect data got “lost”.

Our out of the box API integrations could be used to upload and sync digital behavior along side the customer details. This way you could identify those prospects calling about one product (private event) but has actually spent a lot of time looking at others (brand activation).

The benefits of the solution were clear:

- Time was saved each week on manually transferring data

- There was a reduction in errors, or lost customer data

- Data was captured consistently to enable more targeted and personalised/specific campaigns

Creating a centralized reporting system across an insurer

Our client was a start up life insurance company, with big plans for growth. They had three main systems; a policy administration system, quotes system, and salesforce to mange CRM & partner communications.

As much as each system had their own reporting function, there were a list of over 200 reporting requirements that were not met; a centralised reporting database was needed!

Our team utilised our existing apis & technologies to help pull in the data into a single format. The reporting system was then used to:

- Provide FCA reports in required formats on a quarterly basis

- Provide structured sales reports, looking at; account managers, IFA partners, and product reports

- Apply actuarial formulas to policy data to create valuations

- And 197 more requirements!